Quick Answer: Debit cards are one way to access funds in your bank account. You can use them in many of the same places you would use cash, but feel safer not having to carry cash around, plus enjoy added convenient features.

A debit card can be used for most major purchases, and is generally accepted by most retailers. A debit card can be an excellent way to control your spending habits and reduce credit card debt.

What are the differences between a debit and credit card?

There are several differences between debit and credit cards. For one, credit cards directly affect your credit score. When you use a credit card, you’re using money that is loaned to you by the credit card issuer. When you use a lot of your credit amount and don’t pay it back by your scheduled due date, you start to accrue debt. The more debt you carry on your credit card, the greater impact it has on your credit score and the more interest you have to pay back to the bank. This is not true for debit cards, because debit cards are directly linked to the money you have in your bank account.

The money you spend using a debit card doesn’t positively or negatively affect your credit score, which is why debit cards can be better for certain purchases.

Getting a credit card can also be tricky, especially if you don’t meet certain qualifications. But acquiring a debit card is actually pretty straightforward. Additionally, there are prepaid cards, which are great for those who don’t want to open a bank account.

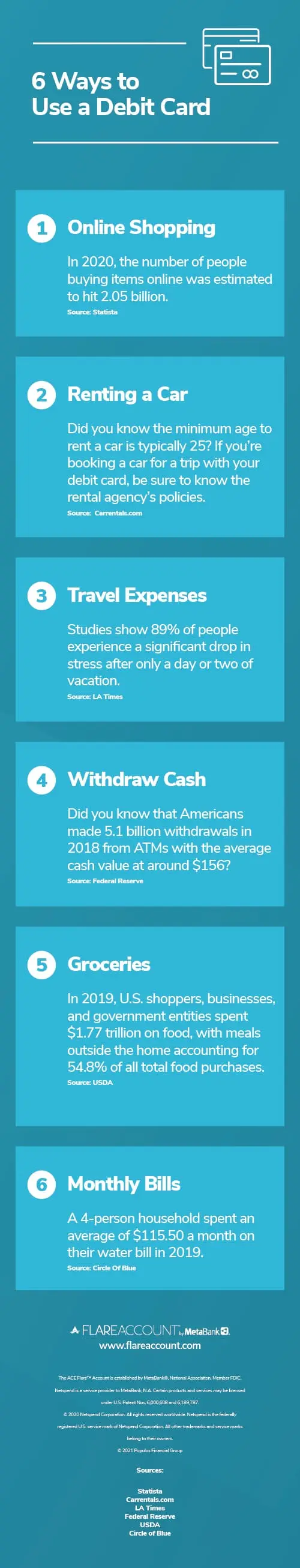

6 Different Ways to Use a Debit Card

Although debit cards don’t contribute to your credit score, there are still plenty of reasons why you should use a debit card. Here are seven different ways you can use your debit card.

1. Online Shopping

There’s no better way to put a hold on an online shopping spree than a debit card. A debit card can prevent you from spending more money than you have, because you are limited to the funds available in your account. And although plenty of credit cards boast cash back rewards, those can encourage credit card holders to spend more in order to earn more perks.

It’s important to note that shopping with a debit card can be just as secure as shopping with a credit card. Many debit cards now offer better protection, and most banks will cap your liability to $50 on a debit card as long as you report any losses within one to two days. If you fail to report the losses in that timeframe, according to the Electronic Funds Transfer Act (EFTA), you still have up to 60 days to report the incident, in which case, you’ll only be responsible for up to $500 in liabilities.

2. Renting a Car

Renting a car with a debit card is possible, although the process is slightly different. When you’re renting a car with a debit card, many car rental companies will request an authorization hold against your debit card account for the estimated charges of the rental, and these funds on hold will not be available for your use. When the rental is over, the held funds will be reversed and released, though the bank may take time to post the released funds back to your account. Some car rental companies will only rent to debit card holders under more limited circumstances, like only at an airport, or if the renter has a ticketed return travel ticket. Therefore, it’s best to call ahead to learn what restrictions there might be.

3. Travel Expenses

When you’re traveling across the globe, you can still use your debit card to cover purchases or withdraw money from ATMs. In fact, you can inform your debit card issuer before your trip so that you can use your debit card in different countries without worry of your card being frozen under suspicion of fraud. Some banks offer low foreign transaction fees, while others may charge more when you make purchases overseas. Keep that in mind when you’re purchasing items internationally.

4. Withdraw Cash

Need to withdraw cash from an ATM? ATMs, otherwise known as Automatic Teller Machines, are outlets that let people withdraw from or deposit funds into their account. You can use ATMs whenever you need to take money out of your bank account, deposit cash, or check the status of your bank account. However, keep in mind that when you use ATMs that are out of your bank network, you may be charged a fee for withdrawing money.

Fortunately, there are debit cards that offer fee-free cash withdrawals.¹

5. Groceries

Using a debit card to pay for groceries is a safer alternative to carrying cash around.

6. Monthly Bills

Paying your monthly bills with a debit card makes sense, if you want to stay within your budget. If you know exactly how much you need to pay each month to cover gas, utilities, water, electricity, and more, you can simplify the process by setting up automatic bill pay to have the amount of your bill automatically withdrawn from your account on a certain day.

Conclusion

From monthly expenses to online shopping, there are several different ways you can use a debit card. Although debit cards don’t usually offer the same reward programs as credit cards, debit cards don’t run the risk of driving up debt.